Features

CBX-FX provides two distinct modules: FX Trading and FX Corporate. These can be offered by a bank, jointly or separately, to its corporate customers. It allows the end-customer to be self-reliant and run an effective FX dealing and hedging operation.

FX Trading allows the bank to provide its customers with:

- Real-time streaming of market rates from different liquidity providers

- Customised workspaces and position currency pairs on workspaces as per specific tracking needs

- Spot and forward rates in the same FX tile

- Flexible order types – One-touch, request for quote and limit orders

- Online rate negotiation with the bank’s representative

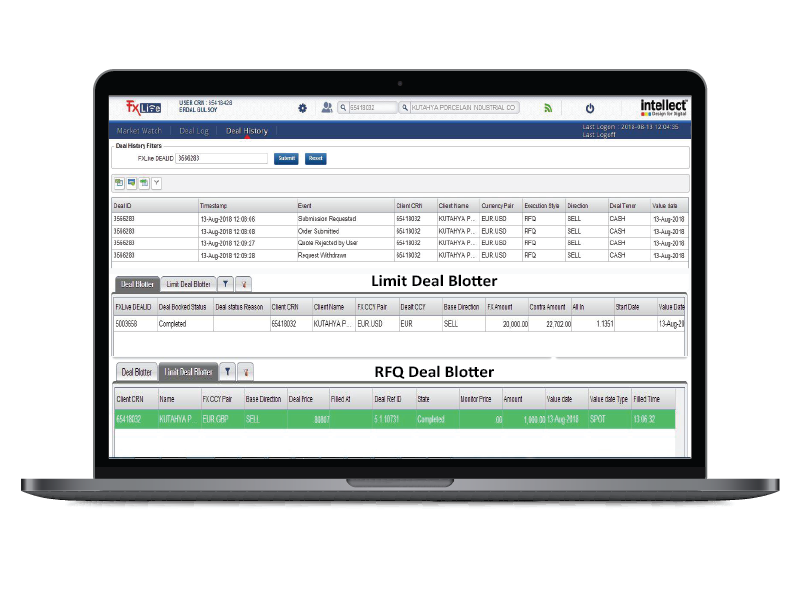

- Deal status tracking and audit trails through convenient blotters

- Instantaneous generation of contract confirmations

- Alerts and news

FX Corporate allows the bank to enable its customers to:

- Aggregate data related to FX receivables and payables (exposures), and FX hedged deals from multiple sources

- Tag exposures to hedged deals

- Unearth unhedged exposures

- Cost the exposures appropriately

- Determine what to hedge, when to hedge and how to hedge

- Utilise 4D simulation tools to arrive at an effective hedging strategy

The bank can control the entire trading function through a configurable entitlement matrix and an in-built audit trail mechanism.

A win-win situation for the bank as well its corporate customers, helping the bank to:

- Generate better fee-based income from increased volumes

- Improve client retention

- Ability to grow the client base quickly

- Straight-Through-Processing from client’s device to treasury back office

- Curate and control client behaviour and yet provide the trading independence

- Increase trading behaviour by providing online hedging strategies

- Become the client’s principal bank by providing value-added tools

For the end customer it translates to:

- Personalised and agile trading platform

- Price Transparency

- Real-time updates across the entire trading lifecycle

- Ability to place a deal at the correct time and correct rate without any dependency

- Having a data-driven mitigation plan for FX exposure risks

- Getting cost benefits from timely hedging decisions

On this website we use first or third-party tools that store small files (cookie) on your device. Cookies are normally used to allow the site to run properly (technical cookies), to generate navigation usage reports (statistics cookies) and to suitable advertise our services/products (profiling cookies). We can directly use technical cookies, but you have the right to choose whether or not to enable statistical and profiling cookies. Enabling these cookies, you help us to offer you a better experience.

Want to know more?

Explore how CBX-FX manages risks associated with a multifaceted banking ecosystem.

Please share your details and we will be happy to schedule an exclusive webinar for your team and you.